Although finance is often depicted as a daunting facet of adult life, accumulating wealth isn’t complicated. Financial security can become almost second nature with The Gamut’s foundational habits — best ingrained at an early age before costly decisions such as student loans set an undesirable precedent on your life.

How 2 don’t debt

While Gen Z has spent the least amount of time in adulthood, they’ve racked up more debt than those who have lived twice, or even three times as long, with an average of $94,000 of personal debt according to a Talker Research poll for Newsweek. Loans, credit cards, and borrowing in general are waterboarding wealth. No matter how low the interest, any monthly payment towards debt takes away from potential investments, savings, or necessities. Debt is designed to snowball; what might start out as a small pothole could quickly multiply to a massive crater of financial burden. This is especially prevalent as credit card companies see the newly certified adult pool—eighteen year old college students—as unemployed, inexperienced, impulsive individuals in need of quick cash.

While certain debts, like mortgages, can be considered investments as they increase in value, most work the opposite way. Car loans, for example, exist as normalized wealth assassins as most cars depreciate by over a quarter in value in two years. When coupled with a loan, costs increase while value goes down, rendering new car purchases simply illogical. When the sixteenth birthday comes around, stay conscious of the set of wheels you decide to sport to maximize the value of your dollar.

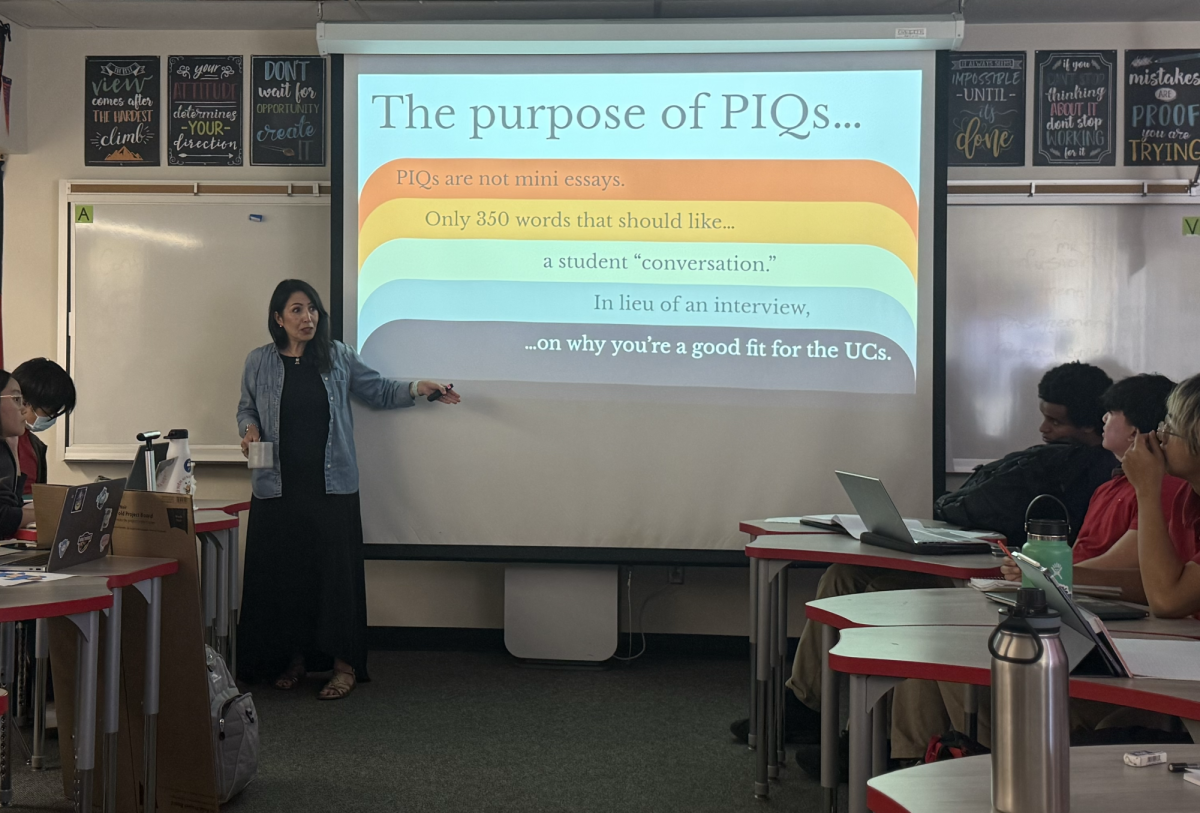

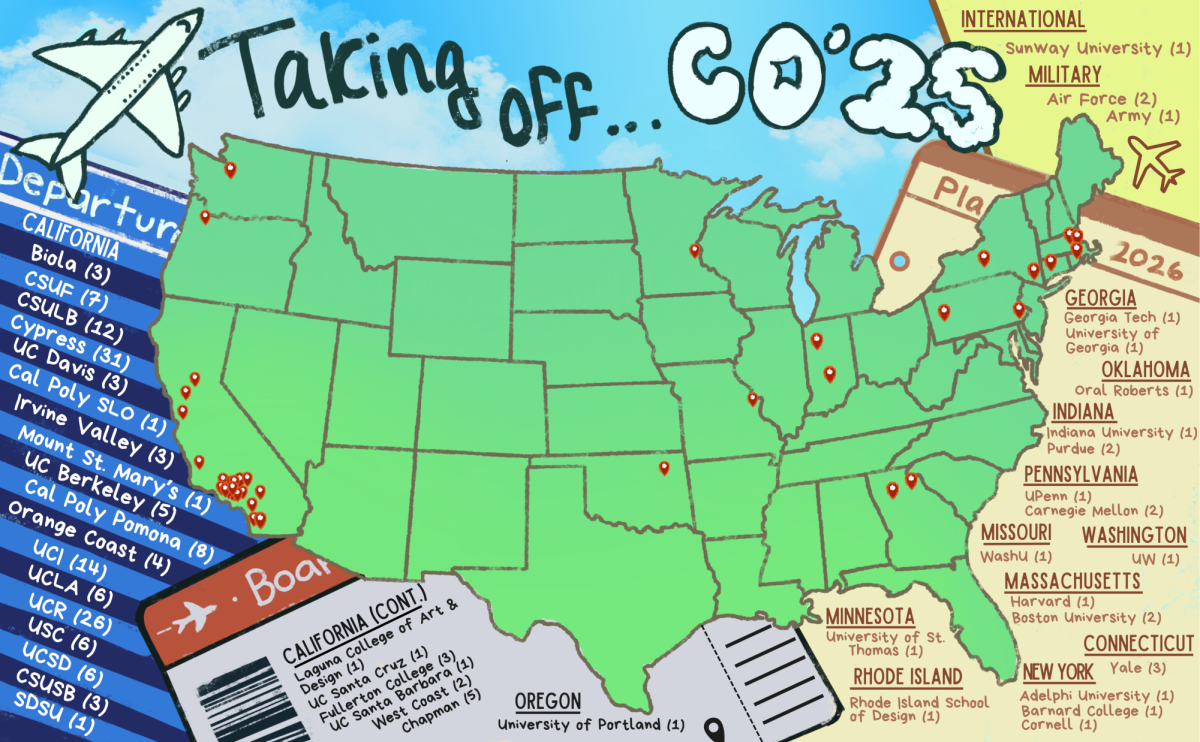

Student loan debt is not so one-size-fits-all, as education quality and starting salary play a large role in deciding whether benefits outweigh costs. However, with so many low-cost educational institutions at our doorstep and the endlessly rising costs of higher education, it’s becoming increasingly difficult to rationalize high-cost tuitions, especially those requiring loans. It’s an unfortunate reality that cost must be a huge factor in college selection — ignoring the price tag can quickly turn college into a 20-year long adulthood nightmare.

Chase Compound Interest

While investing might sound exclusive to Wall Street economists or successful entrepreneurial “Sharks,” it can be a relatively low effort way to steadily increase savings over time. Although investment brokerages require account holders to be 18 or older, within 10 minutes, parents or an older sibling can set up custodial accounts on well-trusted sites such as Fidelity or Vanguard to introduce you to the gracious world of compound interest. Low-risk options such as S&P 500 index funds—a combination of the 500 top traded companies—report a 10% yearly return and provide a minimal stress and time-friendly choice for traders. The uncertain current stock market prospects might deter many from jumping in, but over the long-term time in the market is more valuable than trying to predict the perfect moment. If your risk tolerance is too low, there are plenty of high-yield savings accounts available to open allowing a secure way to accrue some extra interest. Credit unions are another appealing option for those who qualify, as they provide similar services as banks but with more benefits to members since they’re not-for-profit.

Track Expenditures

In the same way a student couldn’t comfortably walk into a final without having studied, expenses shouldn’t be “guesstimated.” Having a firm understanding of where funds are going gives full control of maximizing savings and reaching personal milestones. Laying purchases out in a spreadsheet, document, or even a small notebook can do the trick. There are also various free budgeting apps available to help stay mindful — popular options include Rocket Money or NerdWallet. As understandable as it is to splurge occasionally, if irresponsible recurring patterns are developed, habits could cut into financial prosperity years down the line. Easy cuts to a budget include reducing or eliminating dining out, purchasing off-brand items, and cutting rarely used subscriptions. Frugality is not shameful—it’s a wealth-building tool that even the richest preach.

Society may treat financial discussion as taboo, but normalizing conversations about wealth — or lack thereof — can spread essential economic literacy. Pave a way to a life free of financial burdens, allowing you to be able to prioritize experiences, friends and family, and your own well-being.